Hut 8 Reports Third Quarter 2025 Results

Nov 4, 2025

- 1.5 GW+ expansion program accelerates development flywheel, underscores commercial velocity, and supports long runway for growth

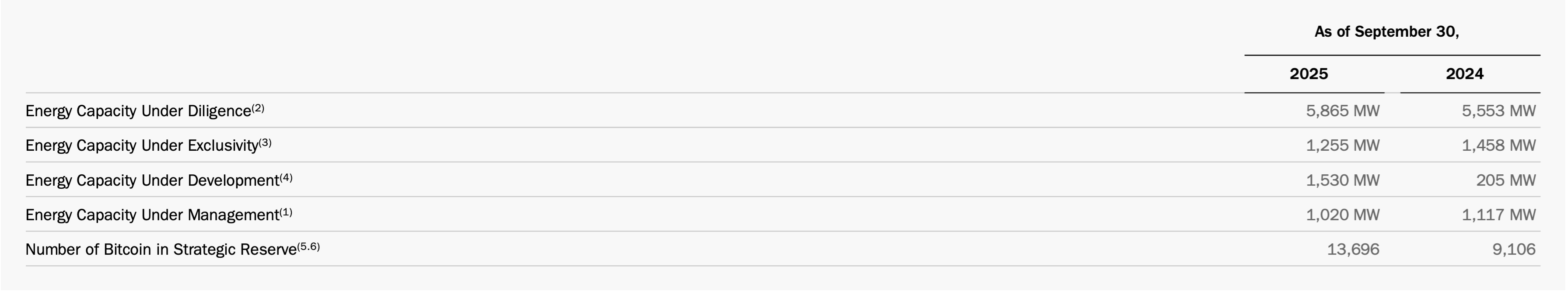

Notes

- Comprises all Power assets: Power Generation, Managed Services, ASIC Colocation, CPU Colocation, Bitcoin Mining, Data Center Cloud, and non-operational sites.

- Sites identified for large-load use cases such as high-performance computing and Bitcoin mining, industrial applications such as next-generation manufacturing, and other energy-intensive technologies. At this stage, Hut 8 assesses site potential by engaging with utilities, landowners, and other stakeholders to evaluate critical factors, including power availability, infrastructure readiness, fiber connectivity, and overall commercial viability.

- Sites where Hut 8 has secured a clear path to ownership through either: (1) an exclusivity agreement that prevents the sale of designated power and/or land capacity to another party or (2) a tendered interconnection agreement, confirming a viable path to securing power and infrastructure for deployment.

- Sites where Hut 8 is actively investing in development and commercialization by executing definitive land and/or power agreements, advancing site design and infrastructure buildout, and engaging with prospective customers.

- Number of Bitcoin in Strategic Reserve includes Bitcoin held in custody, pledged as collateral, or pledged for a miner purchase under an agreement with Bitmain.

- As of September 30, 2025, of the 13,696 Bitcoin in Strategic Reserve, 10,278 Bitcoin were held by Hut 8, and 3,418 Bitcoin were held by American Bitcoin. As of September 30, 2024, all 9,106 Bitcoin in Strategic Reserve were held by Hut 8 as American Bitcoin had not yet been launched.

- Starting April, 1, 2025, the Company’s Bitcoin mining operations are generally conducted through the American Bitcoin majority-owned subsidiary. As of September 30, 2025, ~25.0 EH/s of the Company's total hashrate of ~26.8 EH/s was owned by American Bitcoin. Of the total hashrate, ~23.7 EH/s was operational as of September 30, 2025, including ~1.8 EH/s held by Hut 8 through its ownership stake in the King Mountain Joint Venture in which the Company has a 50% membership interest and a Fortune 200 renewable energy producer has the remaining 50% membership interest.

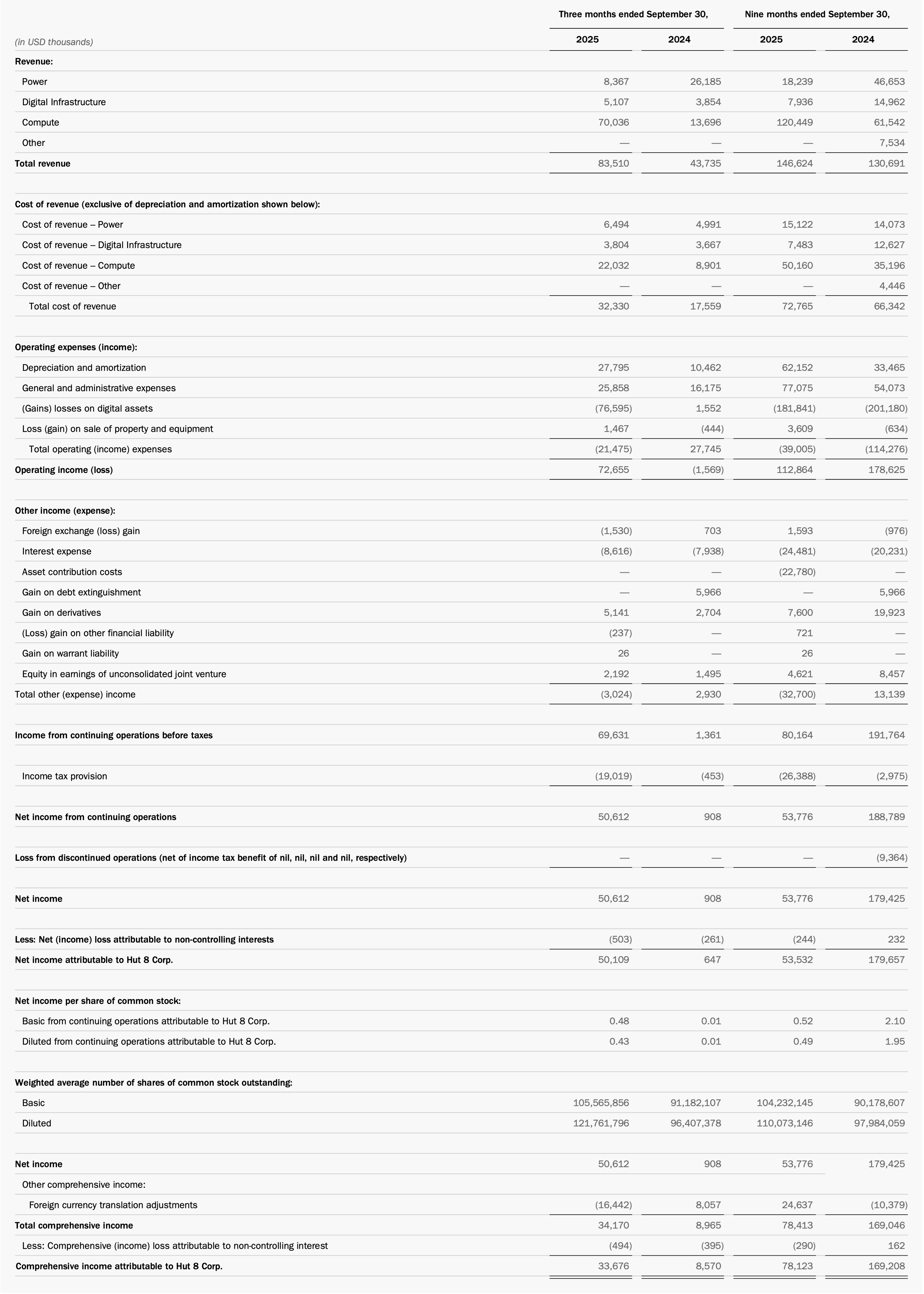

Notes

- Net of the accretion of fair value differences of depreciable and amortizable assets included in equity in earnings of unconsolidated joint venture in the Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income in accordance with ASC 323. See Note 10. Investments in unconsolidated joint venture of our Unaudited Condensed Consolidated Financial Statements for further detail.

- Non-recurring transactions for the three months ended September 30, 2025 primarily represent approximately $2.9 million of American Bitcoin related transaction costs. Non-recurring transactions for the three months ended September 30, 2024 represent a $13.5 million contract termination fee received from MARA Holdings and a release of relocation fees that were over-accrued in the prior period.