Hut 8 Reports First Quarter 2024 Results

May 15, 2024

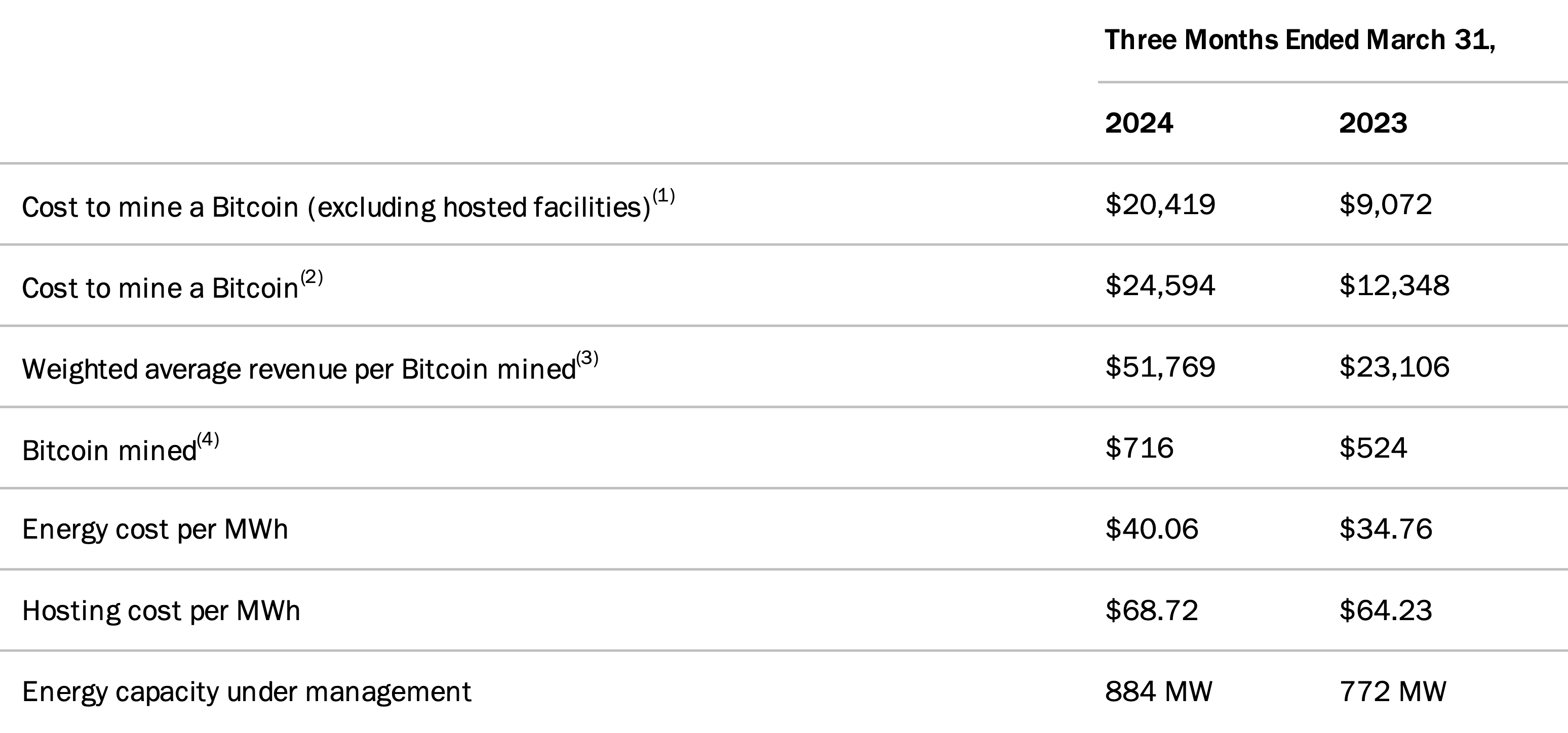

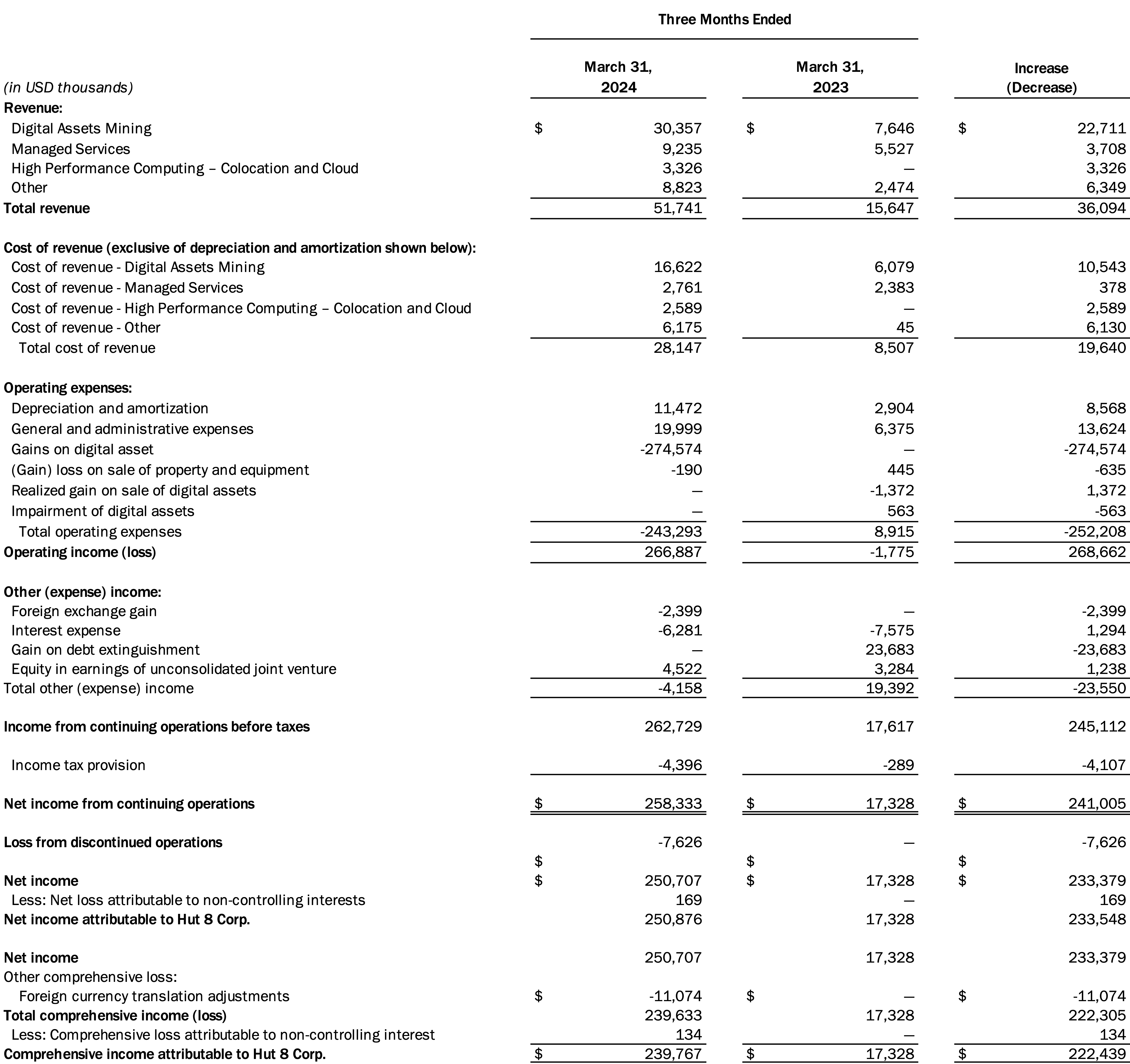

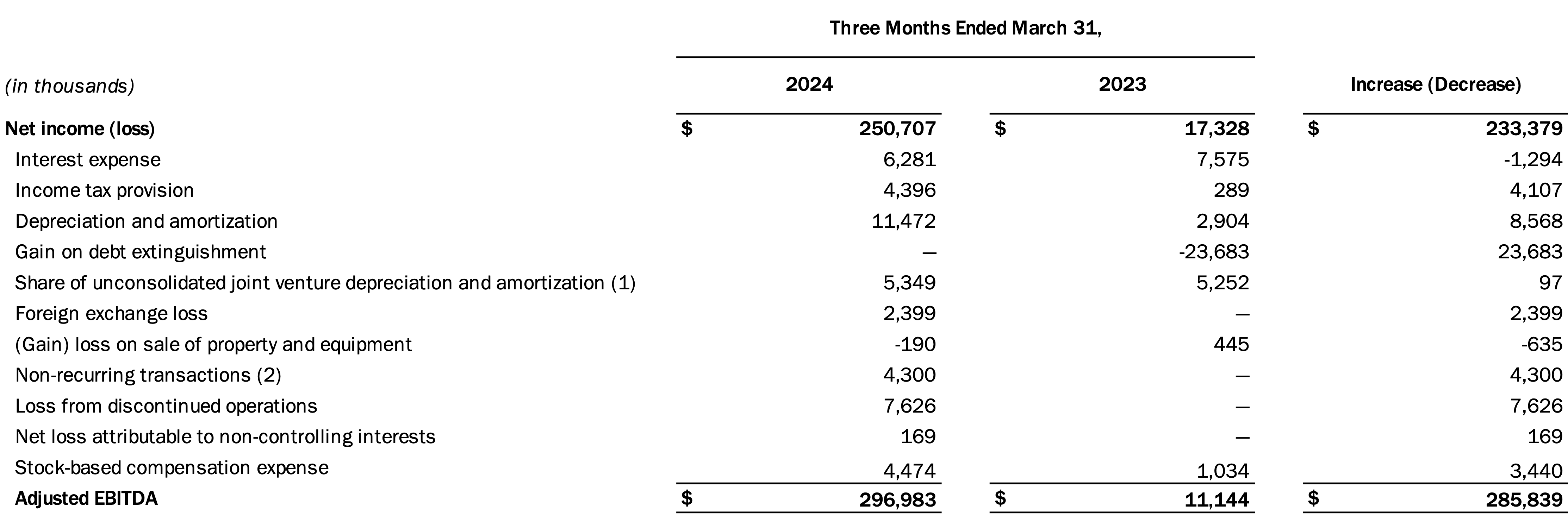

- Revenue of $51.7 million, Net Income attributable to Hut 8 Corp. of $250.9 million, and Adjusted EBITDA of $297.0 million

- 9,102 self-mined Bitcoin on balance sheet as of March 31, 2024

Notes

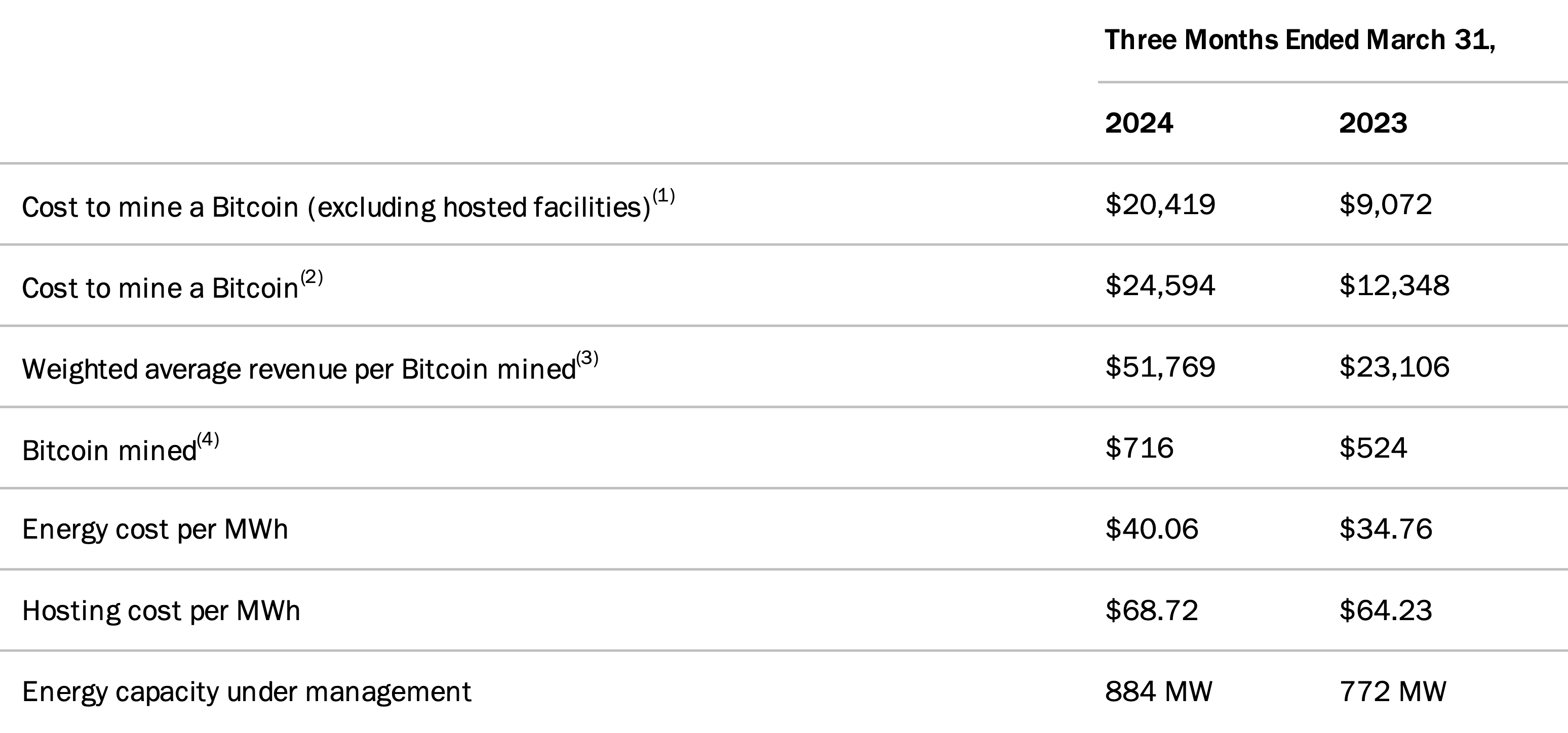

- Cost to mine a Bitcoin (excluding hosted facilities) is equivalent to the all-in electricity cost to mine a Bitcoin at owned facilities and includes our net share of the King Mountain JV.

- Cost to mine a Bitcoin (or weighted average cost to mine a Bitcoin) is calculated as the sum of total all-in electricity expense and hosting expense divided by Bitcoin mined during the respective periods and includes our net share of the King Mountain JV.

- Weighted average revenue per Bitcoin mined is calculated as the sum of total self-mining revenue divided by Bitcoin mined during the respective periods and includes our net share of the King Mountain JV; it excludes our discontinued operations at Drumheller, Alberta.

- Bitcoin mined includes our net share of the King Mountain JV and excludes our discontinued operations at Drumheller, Alberta. Bitcoin mined excluding our net share of the King Mountain JV was 592 and 326 for the three months ended March 31, 2024 and 2023, respectively.

Notes

- Net of the accretion of fair value differences of depreciable and amortizable assets included in equity in earnings of unconsolidated joint venture in the Consolidated Statements of Operations and Comprehensive Income (Loss) in accordance with ASC 323. See Note 8. Investment in unconsolidated joint venture of the Company’s Unaudited Condensed Consolidated Financial Statements for further detail.

- Non-recurring transactions for the three months ended March 31, 2024 represent approximately $1.4 million of transaction costs related to the Far North acquisition and $2.9 million related to restructuring cost.